Battery swapping is a potential solution to address a key barrier to electric vehicle (EV) adoption: vehicle affordability. The topic holds interest in the EU and the US, although it has not been commercialized due to disparate vehicle platforms and lack of standardization. Recently, battery swapping has gained attention in Southeast Asia and South Asia. Arthur D. Little (ADL) analyzed the practice’s feasibility among major vehicle segments through a total cost of ownership (TCO) approach and review of qualitative factors. In this Viewpoint, we examine viable solutions, considering revenue maximization and cost optimization.

In light of carbon-neutrality targets, decarbonization of the transport sector is a priority for emerging markets such as Asia and Africa. EV affordability remains one of the greatest challenges for mass-scale electrification. Moreover, refueling of EVs via conventional charging is a time-consuming process. Battery-swapping technology offers advantages including reduced EV costs, low financing, longer vehicle life, and short refueling periods. Despite its many advantages, however, the battery-swapping market is expected to reach just US $38 billion by 2030. According to estimates by ADL, the value of the charging infrastructure is $113 billion — around three times the swapping market.

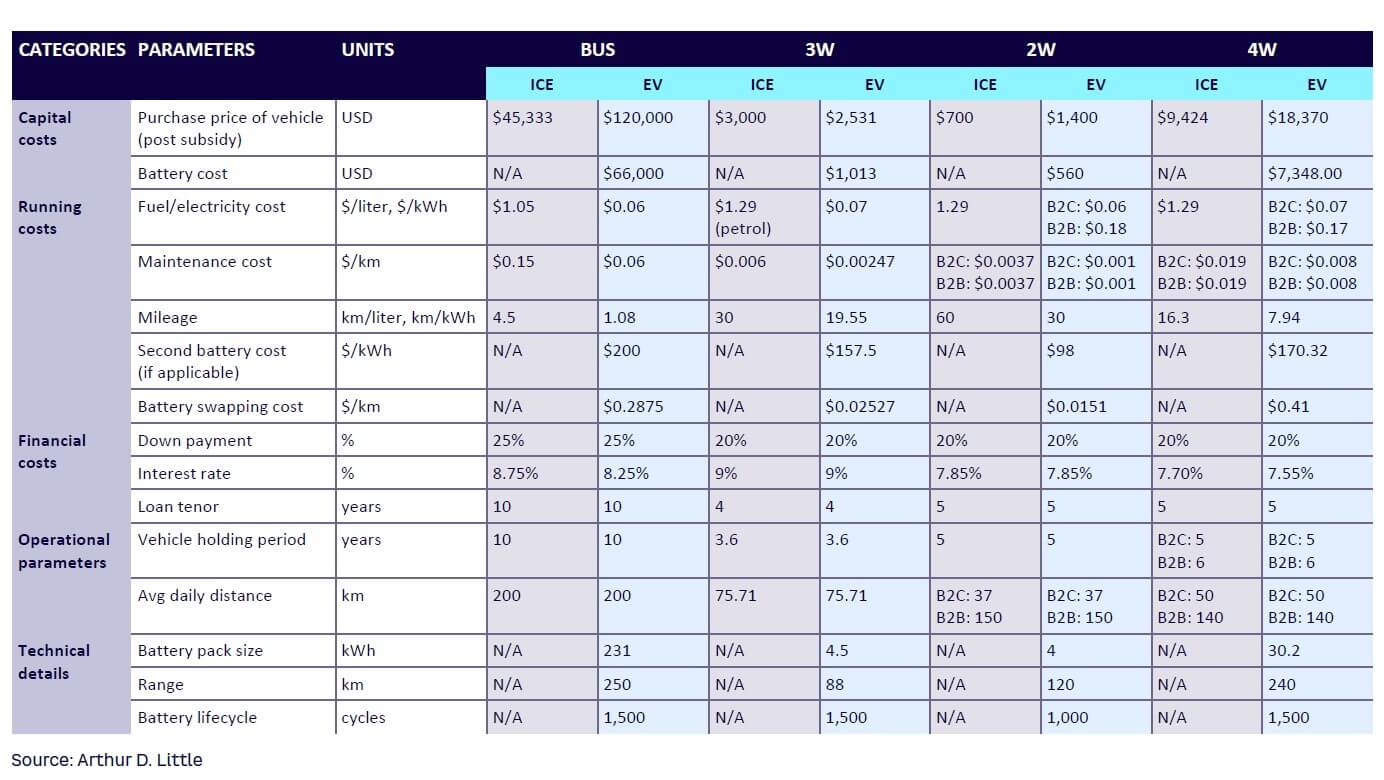

ADL has explored battery swapping across different vehicle segments in the Asian market, taking both quantitative and qualitative approaches to determine overall feasibility. This Viewpoint focuses on the Asian and emerging markets to reflect the cost parameters for TCO calculation (TCO calculations were performed per assumptions shown in Table 1). To be considered in other markets or regions, the local cost parameters of battery swapping must be weighed, as well as local considerations such as grid infrastructure, vehicle diversity, size of vehicle, and battery type.

BATTERY SWAPPING OVERVIEW

To counter climate change, carbon neutrality has emerged as a key topic in the last 12-18 months, which has accelerated efforts of electrification in many major Southeast Asia and Asia-Pacific economies, where the transport sector remains one of the primary contributors to carbon emissions. Electrification is an effective tool to decarbonize, although several barriers exist in terms of cost, range anxiety, and uncertainty around charging infrastructure.

To address some of these challenges and as an alternative to a charging infrastructure, battery swapping allows EV owners to swap out their used batteries for fully charged ones. Battery swapping has some key value propositions, including:

-

Reduction in EV cost. The battery constitutes 30%-40% of the overall cost of an EV. In the swapping model, the battery is not part of the cost of the vehicle, thereby addressing the issue of affordability.

-

Faster turnaround. Battery swapping can be executed in less than five minutes — similar to refueling an internal combustion engine (ICE) vehicle — resulting in minimal vehicle downtime.

-

Effective use of real estate for EV fueling. A swapping station built on 25 square meters of area can serve a swap every five minutes (or 12 in an hour), while a fast charging station can charge in the range of three to six cars per hour.

Comparing market size, the charging infrastructure is around three times larger than swapping, which means that despite the positives of swapping, there are some fundamental challenges that limit its prospects. Some of those challenges include:

-

Intensive initial capital. The battery-swapping business is capital-intensive, as operators must invest in battery stock. Moreover, the large variety of vehicles requires stocking of many types of batteries. Estimating the most optimum battery SKUs is difficult.

-

High maintenance cost. The charging equipment in battery-swapping stations requires regular maintenance to prevent corrosion and other damage, raising the overall maintenance cost of a swap facility.

-

Operational hazard and safety challenges. The explosive nature of batteries at battery-swapping stations, especially with low-quality batteries entering the market, highlights the need for regulations and oversight to ensure safe operation.

BATTERY SWAPPING FEASIBILITY VIA TCO

A TCO comparison provides a way to calculate and then fairly compare the cost of owning and operating a vehicle over a period of time. In principle, TCO aims to identify the trade-offs for customers and enables them to make informed decisions when purchasing a vehicle. In this Viewpoint, we compare three vehicle types: ICE, EV sold with fixed battery, and EV sold with a swappable battery. The vehicle categories include buses, three-wheelers (3Ws), two-wheelers (2Ws), and four-wheelers (4Ws). (Trucks were excluded from the analysis due to insufficient comparable models and data around swapping for this vehicle segment.)

Feasibility for buses via TCO approach

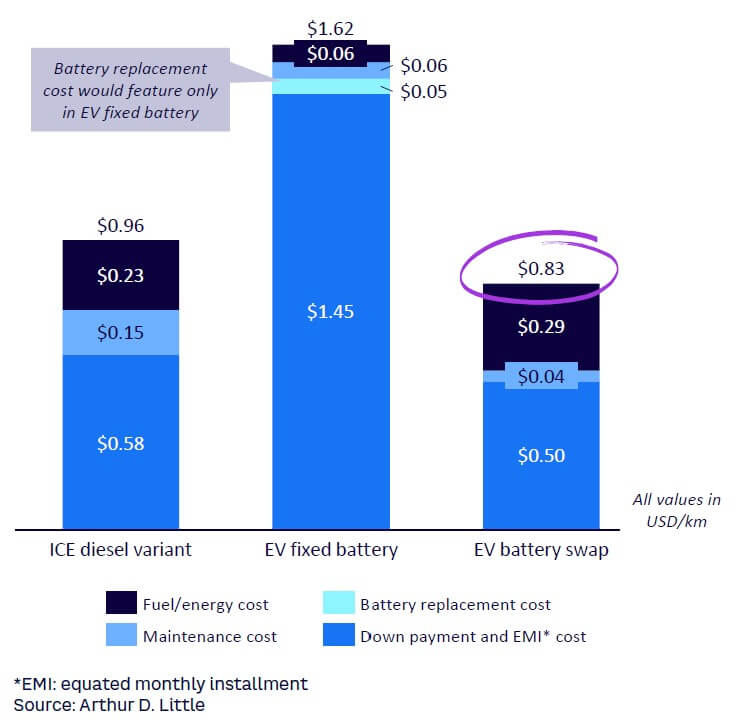

ADL’s analysis of the TCO of buses reveals that EV battery swaps are lower than ICEs in this segment (see Figure 1).[1] The ICE variant used a diesel bus for comparison, as the majority of emerging markets continue to opt for diesel in this segment. While EV battery swapping is comparable to the ICE, the EV fixed battery is nearly twice the cost of the ICE. As a result, some potential exists for battery swapping in the case of e-buses.

Given that buses are handled by public transport bodies, which are under government jurisdiction, rollout of battery swapping is easier to execute if a business case exists. The limited rollout of swapping in buses indicates that there are other qualitative and behavioral factors that are vital to assessing the overall feasibility. The availability of sufficient power and land to set up infrastructure at transport depots are key supply-side bottlenecks, but other operational factors may also be relevant. We explore these factors later in this Viewpoint.

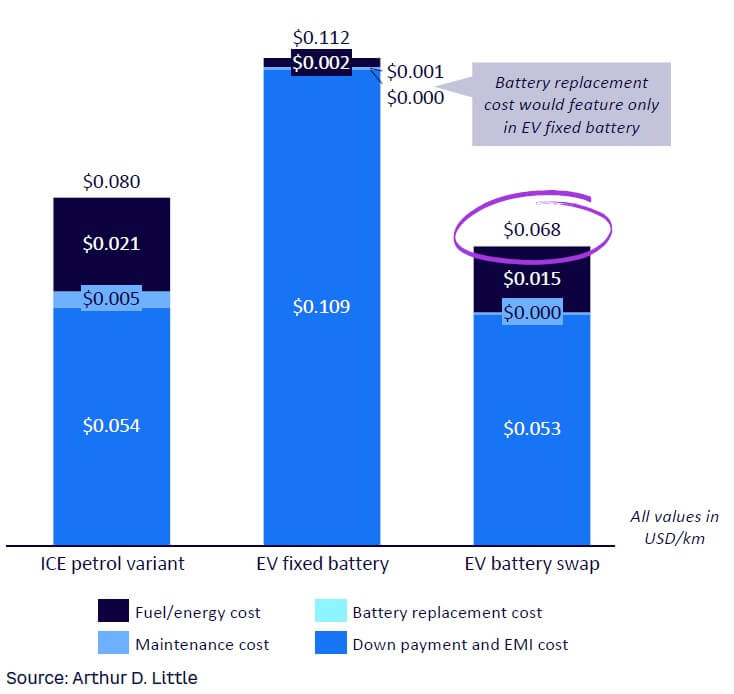

Feasibility for 3Ws via TCO approach

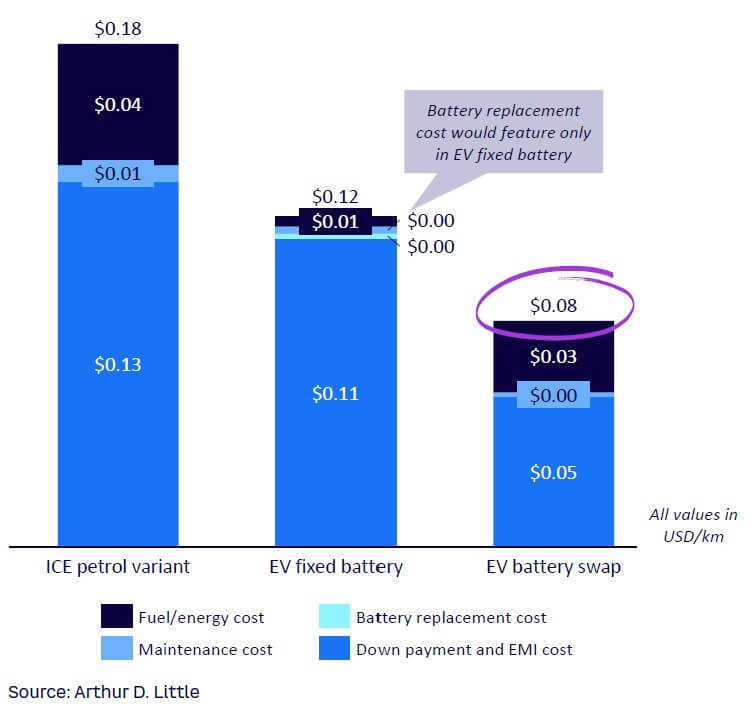

The TCO for 3Ws, as shown in Figure 2, reveals that both fixed-battery EVs and swappable-battery EVs are lower than the ICE variant (in this case, petrol).

When it comes to the 3W market, several B2B logistics players have been willing to switch to EV given the cost savings as well as to promote sustainability-based initiatives. In this way, they can differentiate their offering and target global accounts such as Amazon, P&G, Nestlé, L’Oréal, and Tyson Foods, Inc., which have committed to opting for cleaner logistics in their carbon-neutrality initiatives.

India has seen rapid growth in electric 3W sales, with penetration rates reaching more than 50% in the segment. Major 3W markets in Southeast Asia, such as the Philippines, are also considering the transition to electric 3Ws. In the Philippines, electric 3W vehicle from Indian OEMs have seen great success. Favorable TCO results for 3W EV battery swapping present a lucrative opportunity for potential entrants in 3W manufacturing, especially via the battery-swapping business, but the trend needs to be validated by qualitative factors within a region.

Feasibility for 2Ws via TCO approach

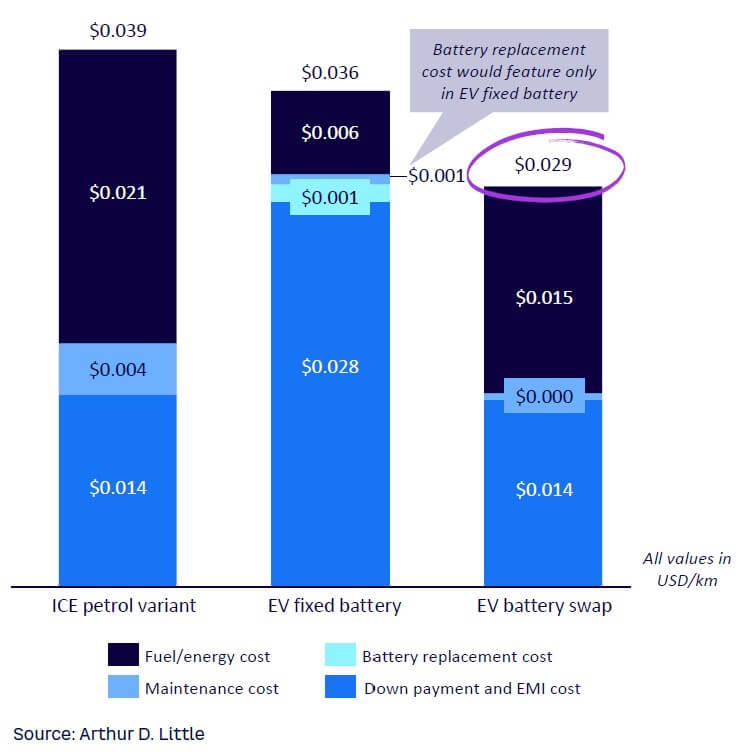

Within the topic of 2Ws, two separate cases exist: B2B applied to ride-hailing and logistics firms, and B2C for the end user.

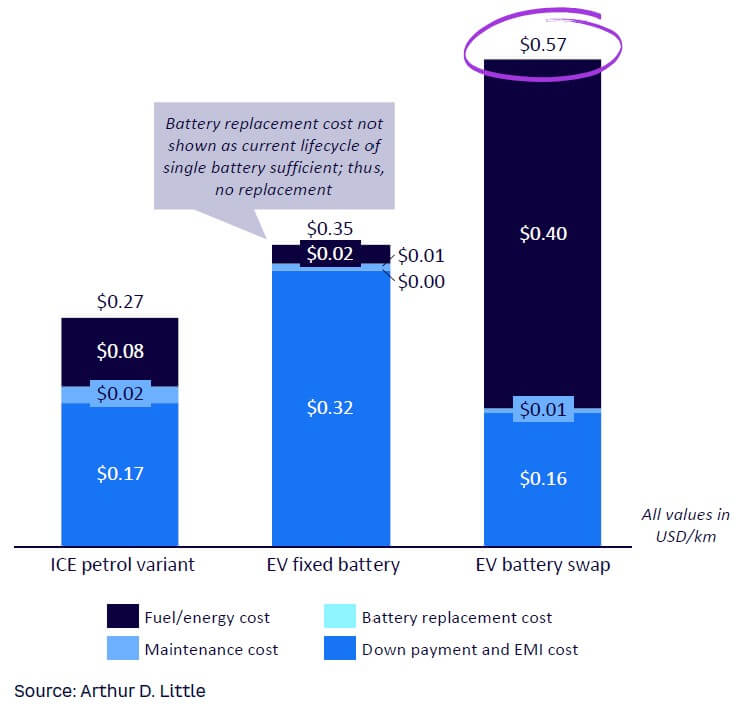

B2B

The TCO for 2W B2B, as shown in Figure 3, reveals both EV fixed battery and EV battery swap to be lower than the ICE variant. Favorable TCO is possible through high vehicle utilization, increasing the economic viability of EVs and implying a significant opportunity for electric 2W manufacturers to target fleet and ride-hailing companies. The battery-swapping case is most attractive, providing almost 25.5% savings from ICE and 19.3% from EV fixed battery. For B2B players, such savings are significant, resulting in a favorable business case for EV manufacturers with a swappable variant as well as operators of swapping stations.

Major markets in Asia, Southeast Asia, and Africa are focusing on electric 2Ws in B2B with a swappable variant, with several companies and start-ups launching swappable variants (see Table 2).

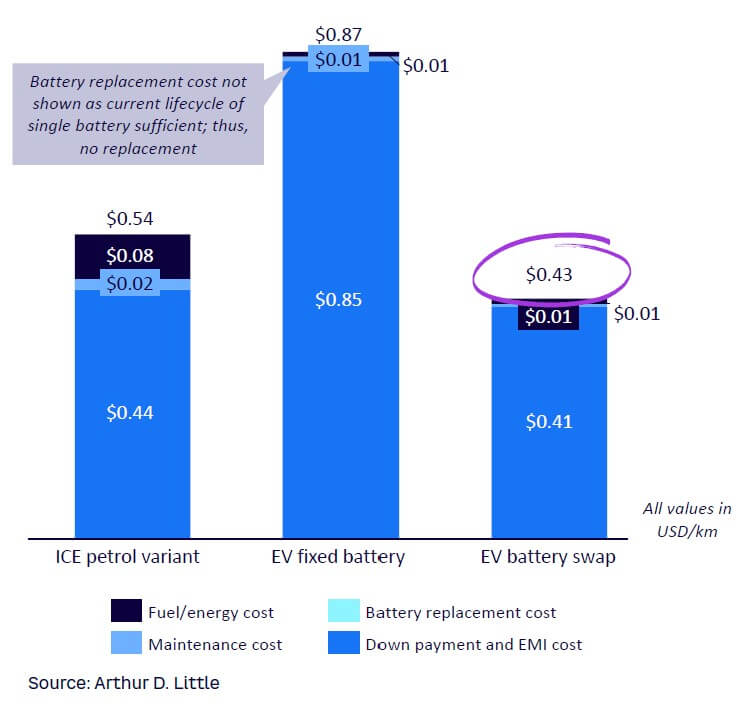

B2C

The TCO for 2W B2C, as shown in Figure 4, reveals the EV battery swap to be marginally lower than the ICE variant, while the EV fixed battery is much higher. A key reason for this trend is lower vehicle utilization in the case of B2C, where ADL analysis found the average daily distance is only 37 km driven over 279 days in a year, compared to B2B cases where average daily distance is 150 km driven over 317 days in a year. High vehicle utilization increases the economic viability of EVs in general because the savings from lower operational costs can be amortized over the purchase cost difference.

The feasibility of battery swapping in 2Ws for both B2B and B2C requires an analysis of qualitative factors, as we will explore below.

Feasibility for 4Ws via TCO approach

As in the case of 2Ws, two cases need to be discussed separately for 4Ws: B2B applicable to ride-hailing and logistics firms, and B2C for end users.

B2B

The TCO for 4W B2B, as shown in Figure 5, reveals EV battery swapping to be significantly higher compared to EV fixed battery, while the ICE variant is the lowest. The key reason for this result is the high cost of fuel and swapping, which is estimated at $0.41 per km, making the swapping model more expensive. As a result, EV battery swapping is not viable from a TCO perspective in this segment.

B2C

The TCO for 4W B2C, as illustrated in Figure 6, reveals EV battery swapping to be the lowest, followed by the ICE variant, and then the EV fixed battery. While deployments of 4W B2C in swapping have been limited, the TCO gives us insight into the reason for rollouts of China OEMs, such as NIO. The swappable variant of NIO that is available is cheaper than an EV fixed-battery variant. As with previous segments, however, the analysis of qualitative factors is required to further assess feasibility.

QUALITATIVE FACTORS

The feasibility of battery swapping for the various vehicle segments and use cases included here must be analyzed for a variety of qualitative factors, including user preferences, behavioral factors, and operators’ additional key considerations. The latter factors are those that cannot be easily quantified but have an impact on business feasibility. Even though these are qualitative in nature, their importance cannot be underestimated.

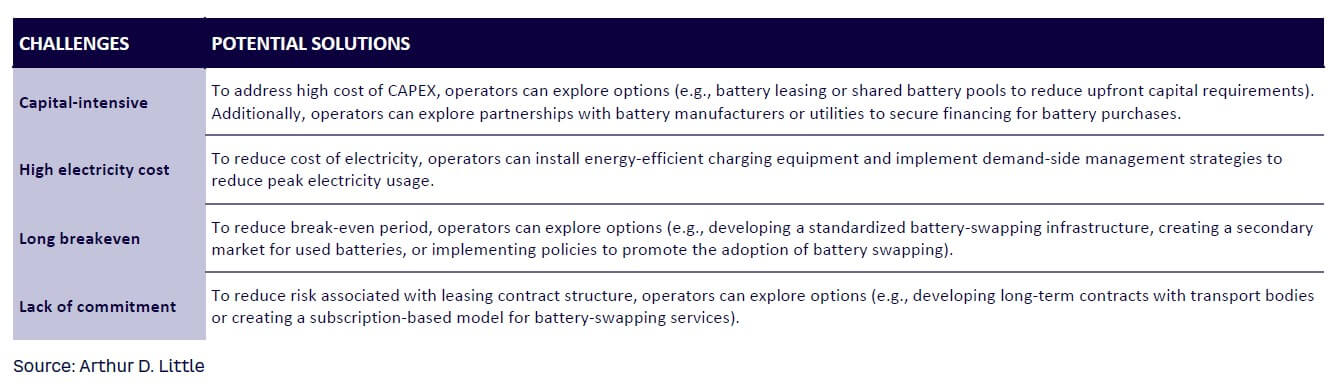

Feasibility for buses via qualitative factors

Because buses are part of public transport (and as such are managed and operated by government transport unions, which can acquire land and electricity cheaply), deployment of EV battery swapping would be easier after other considerations are met. Globally, trials of swapping have been limited primarily to markets such as India and China. However, certain operational factors limit scalability of battery swapping in buses across all markets, including:

-

Capital-intensive. The biggest deterrent for battery swapping is the high cost of CAPEX from the operators’ perspective; with battery capacity of buses being eight times larger than passenger vehicles, the CAPEX for setting up swapping stations becomes 10x greater than passenger vehicles.

-

High electricity cost. The cost of electricity, which is typically 30%-35% in a 2W/4W swapping station, can increase by as much as 50% with buses, given the high power requirement and the potential for demand charges.

-

Long breakeven. ADL’s assessment reveals a break-even period of longer than seven years for buses, which results in greater uncertainty from an operator’s perspective in terms of asset risk as newer battery technology may become mainstream.

-

Lack of commitment. Operators also face challenges with government transport bodies moving to leasing contracts, making long-term commitments from customers uncertain.

Based on the challenges identified above, battery swapping in buses is not currently a viable option, although ADL benchmarking analysis of e-bus swapping station rollouts reveals potential solutions for these challenges, as shown in Table 3.

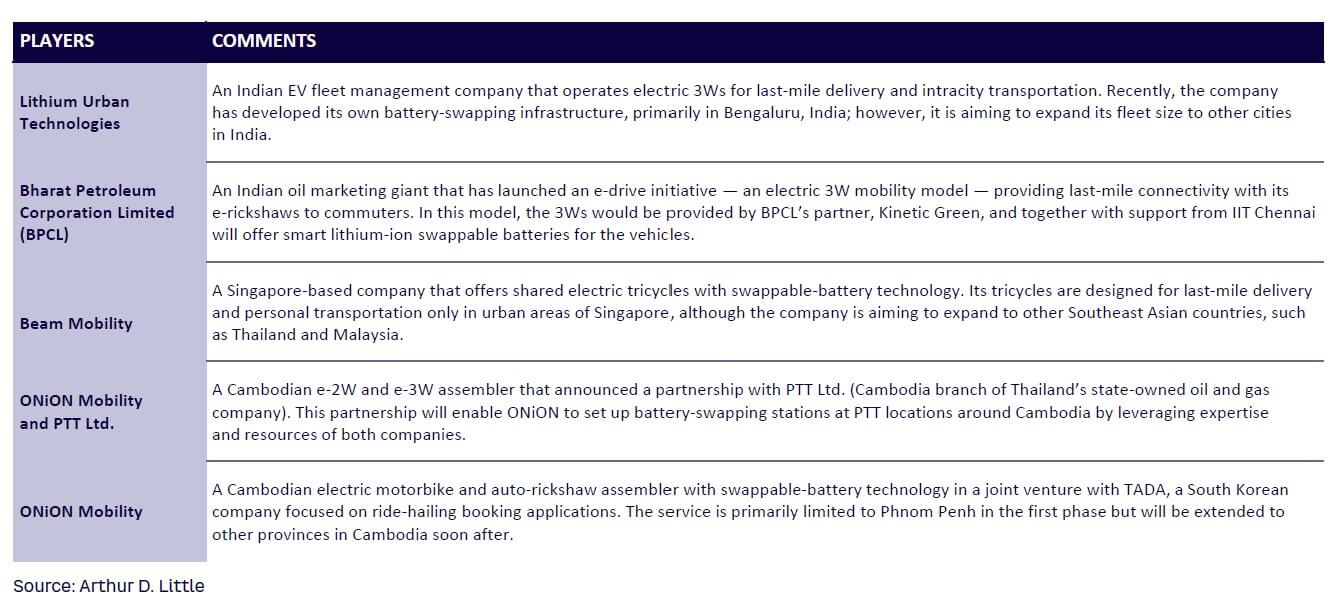

Feasibility for 3W via qualitative factors

ADL estimates the market for electric 3Ws to be ~$6 billion by 2030. Deployments of electric 3W via a swappable variant are seen in markets such as China, India, Australia, Africa, and Latin America. These vehicles are becoming increasingly popular due to their low cost of ownership, zero emissions, and ease of maintenance. The swappable battery variant allows for quick and convenient battery replacement, which helps to increase the range and reduce downtime. This makes them an attractive option for use in shared mobility, tourism and leisure, personal trucking, last-mile delivery, and other commercial applications. Table 4 shows multiple swappable-based initiatives for electric 3Ws deployed across various markets, especially in India and China.

Qualitative factors contributing to a favorable outlook for swappable variants of electric 3Ws include:

-

Overcoming product challenges. Current electric 3Ws typically offer a range of only 70 km, while the typical daily requirements of such vehicles are at least 150-200 km. Traditional charging infrastructure would result in significant downtime.

-

Tough duty cycle. 3Ws are subject to heavy cargo loads and long daily distances. This means that the batteries used in these vehicles should be of reasonable quality. However, this would add to the cost of the vehicle, making it more expensive. A better alternative is to offer a swappable battery variant.

-

Modular structure of batteries. Swappable models are typically modular, allowing the size and weight to be adjusted according to the needs, and resulting in better vehicle efficiency and optimization of range requirements.

-

Moderate CAPEX. The swappable battery business for 3Ws is similar to that of electric 2Ws. The similarities allow operators to target both segments and increase the number of swaps per day. Additionally, catering to a larger demand allows for cost savings in investments such as land and equipment, making the business more attractive to operators.

ADL concludes from its analysis of these qualitative factors that battery swapping for electric 3Ws is a viable opportunity.

Feasibility for 2W and 4W B2C via qualitative factors

The B2C case for 2Ws and 4Ws can be analyzed together since the qualitative factors are similar:

-

The daily distance is sufficient to be managed by private charging at home, so the need does not exist for swapping services.

-

B2C owners may be reluctant to adopt battery swapping because they have concerns about the specific batteries in circulation and lack of control over the battery in their vehicle. This may be a major deterrent for B2C users. However, some vehicle manufacturers in China are offering swapping services as a market penetration strategy, although the model may not be sustainable in the long run. In addition, some companies are offering customers the option to opt out of swapping services and buy back the battery in markets like Europe.

As a result, our conclusion from analyzing these qualitative factors is that battery swapping for 2Ws and 4Ws in the B2C segment is not viable. A qualitative analysis for 4W B2B is not required, as the TCO for swappable batteries is not viable.

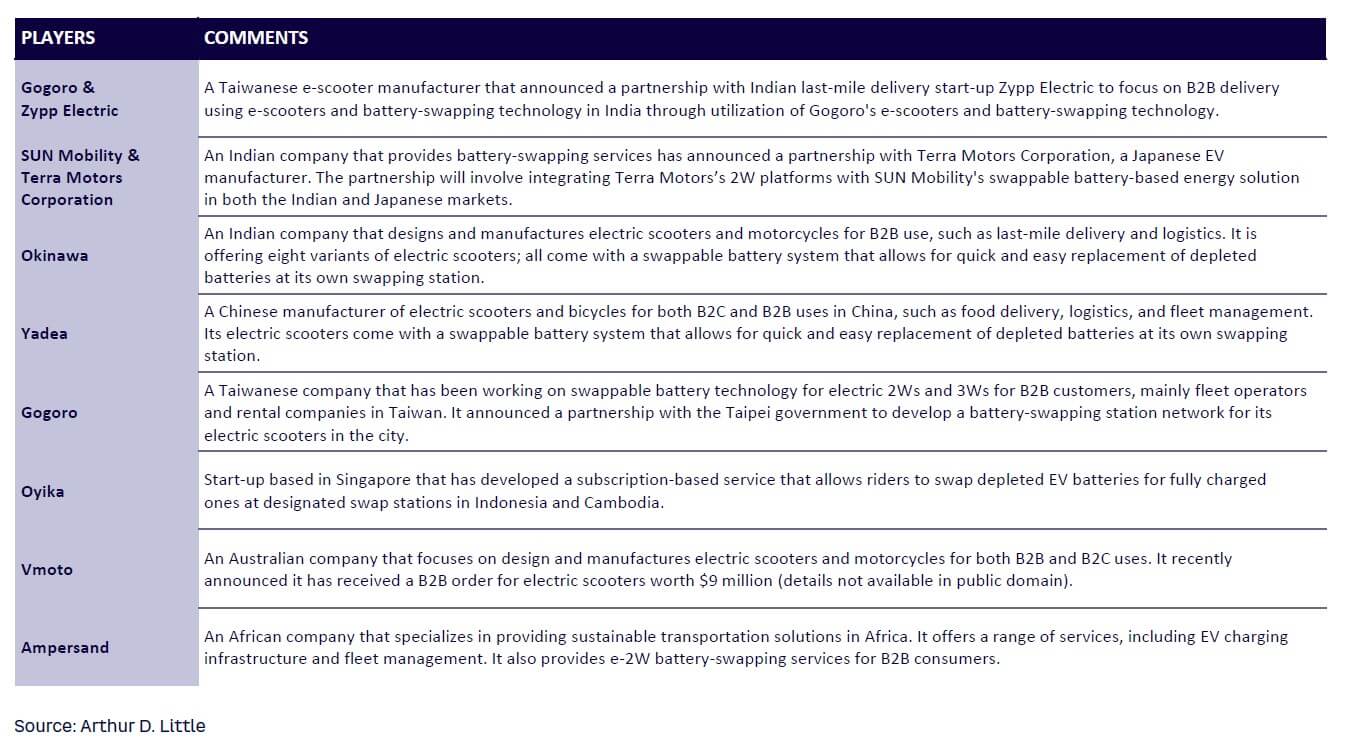

Feasibility for 2W B2B via qualitative factors

The market for electric 2Ws as estimated by ADL is $35 billion by 2030. Deployments of electric 2Ws via a swappable variant can be found in various markets such as by Gogoro in Taiwan, Yulu in India, and Lime in the US. These companies have implemented the technology in scooters and bikes for shared mobility services in urban cities. Table 5 shows multiple swappable-based initiatives for electric 2Ws in B2B deployed across various markets, especially India, China, Indonesia, and Singapore.

The qualitative factors contributing to a favorable outlook for electric 2Ws under a swappable variant include:

-

Affordability. Swappable electric 2Ws are highly affordable, providing an individual who owns one with a means to earn a living.

-

Minimizing downtime. Drivers who use 2Ws for employment typically work an eight-hour shift during which they may travel 150 km/day. Swapping provides the most ideal solution to maximize the eight-hour shift, unlike time wasted for EV charging capabilities.

-

Managing SKUs. In B2B operations, the scope of managing specific battery types is greater than that of the B2C market, as small-scale logistics companies focus more on certain cost-competitive models. This allows swapping station operators to stock batteries of specific models only, making SKU management more manageable.

-

Moderate investment. Batteries for electric 3Ws and 2Ws are ideal for swapping, as they weigh less than 10 kg and can be swapped easily by the vehicle user. It requires no automation support, keeping CAPEX limited to only the battery and swapping station.

ADL concludes from the analysis of these qualitative factors that batter swapping for electric 2Ws in the B2B case is viable.

Conclusion

TAPPING INTO THE MARKET

ADL’s analysis of battery-swapping segments found that B2B 2Ws and 3Ws currently offer the best opportunities. Low profitability remains a concern, as the battery-swapping fee is the main source of revenue, while expenditures exist in terms of high CAPEX, spare battery inventory, and operational and maintenance costs. To develop a feasible business case, ADL recommends operators take a two-pronged approach that focuses on maximizing revenue and minimizing cost, as outlined below.

Maximize revenue

-

Captive sale/demand. Partner with fleet operators or operate a fleet business to ensure a captive demand that results in assured offtake.

-

Flexible pricing schemes. Based on customer type and preference, adjust fee structures either to per swap, per km, or by subscription model, enabling top-line maximization.

-

Multiply revenue streams. Utilize multi-channel income sources such as swapping center advertising and enter into the battery recycling business over the medium term, generating income through extraction of spent materials in the batteries. Position swapping stations close to convenience stores to increase foot traffic and bring additional revenue to the store. Charge a commission for increased sales.

Minimize cost

-

Partnership and hybrid models. Implement a joint partnership or hybrid model to reduce investment in batteries and swapping infrastructure, explore feasibility of a franchise model, and configure the business portfolio toward an asset-light model by considering leasing the swapping technology and exploring partnerships with local stores.

-

Interoperability. Operating in B2B segments, especially fleet business, would allow minimizing the different types of battery inventory, keeping it at optimum level.

-

Focused expansion of station. Launch stations in high-density areas to ensure sufficient offtake and profitability and consider expansion only if there is proven demand of offtake in the near future.

-

Use incentives for electricity and physical infrastructure. Lobby with governments for a subsidized cost of electricity, which is close to 35%-40% of the cost of a swapping station. Similarly, governments may offer physical infrastructure at a subsidized cost, which is typically 20%-22% of the cost of a station.

Potential market entrants are encouraged to evaluate the feasibility of battery swapping in the 2W and 3W B2B segments, while making sure to consider the “maximize revenue/minimize cost” levers listed above when deciding about entry into the battery-swapping business. The market opportunity exists, given the right market-entry and target-segment strategy.

Note

[1] Some values in the figures in this Viewpoint are reported as zero because the total absolute expenditure was converted on a per unit basis. For actual overall cost, see Table 1 for assumptions.