Hydrogen-powered trucks offer the promise of an attractive alternative to battery electric (BEV) trucks for tackling the challenge of decarbonizing heavy-duty and long-haul trucking. As the production cost of hydrogen decreases and the investment in relevant infrastructure grows, hydrogen fuel cells will emerge as a commercially viable green alternative that will outcompete fossil fuels. In this Viewpoint, we explore the future of hydrogen trucking.

HYDROGEN TRUCKING: AN ALTERNATIVE FOR SELECTED APPLICATIONS

Increased demand for green trucking and net-zero corporate ambitions have put pressure on the transportation industry to decarbonize. Approximately a third of greenhouse gas emissions generated by road transport comes from heavy-duty vehicles. Though these vehicles comprise only a small percentage of all vehicles on the road, the whole economy depends on them to transport food, raw materials, manufactured goods, and so on. Arthur D. Little (ADL) has examined the advantages of hydrogen trucking and the roadblocks it needs to navigate to become commercially viable.

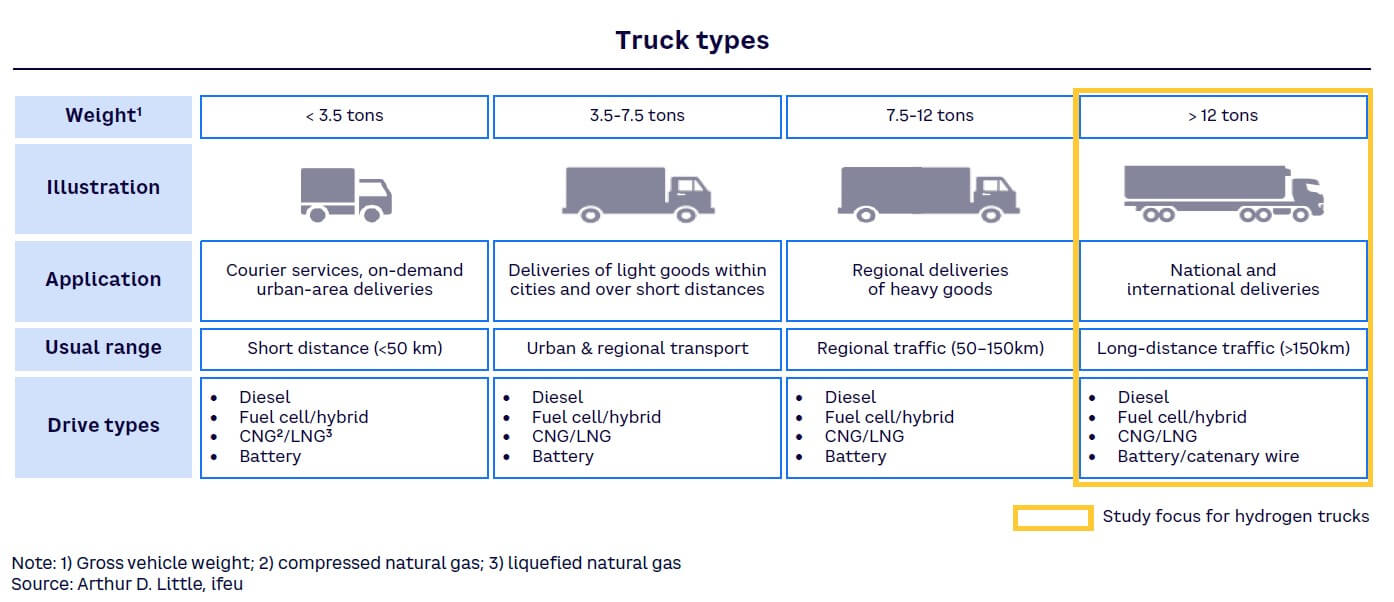

Developments have improved electrified powertrains, which provide a cost-competitive option for many truck use cases, especially for lighter vehicles (under 12 tons) and shorter-distance transport (under 150 kilometers). However, the large payloads and range requirements of heavy-duty trucks (over 12 tons) used for long-distance transport (over 150 kilometers) make them poor candidates for battery electric solutions.

The size and weight of heavy-duty truck batteries would lead to restrictions in payload volumes. Figure 1 shows an approach to organizing trucks into weight-related categories.

While significant investments are expected to improve the performance of BEV trucks, like the Tesla Semi, challenges will likely remain for more demanding trucking applications. Hydrogen-based fuel cell powertrains pose an attractive green alternative to BEV trucks for heavy-duty, long-haul trucking. With efficient onboard storage, hydrogen-powered trucks promise fast refueling and long-distance ranges.

THE CASE FOR LONG-DISTANCE HYDROGEN TRUCKING

The technology required for hydrogen trucking has been developing rapidly; some original equipment manufacturers (OEMs) already have hydrogen heavy-duty trucks in fleet service (e.g., Hyundai in Switzerland and Germany). Currently, the number of hydrogen-powered trucks is small, but is expected to increase rapidly through 2030. Performance and cost are under close scrutiny, as they are fundamental to overall success. Hydrogen trucks show promise in vehicle range and related charging in heavy-duty, long-haul applications.

Performance: Faster charging times, distance ranges

Long-haul trucks have substantial energy requirements and must travel long distances on regulated driving schedules; charging station availability and distance range are important considerations. Compared to BEVs, hydrogen trucks feature refueling times that are shorter than electric charging times and are comparable with current diesel models (15 minutes for hydrogen trucks versus 90 minutes for BEV trucks). It is anticipated that long-haul hydrogen trucks will have operational ranges between 1,000 and 1,500 kilometers, which is comparable to current diesel models. These ranges will support a higher degree of truck utilization compared to current and future BEV alternatives and their ranges of 300 to 800 kilometers.

Cost: Examining potential for savings

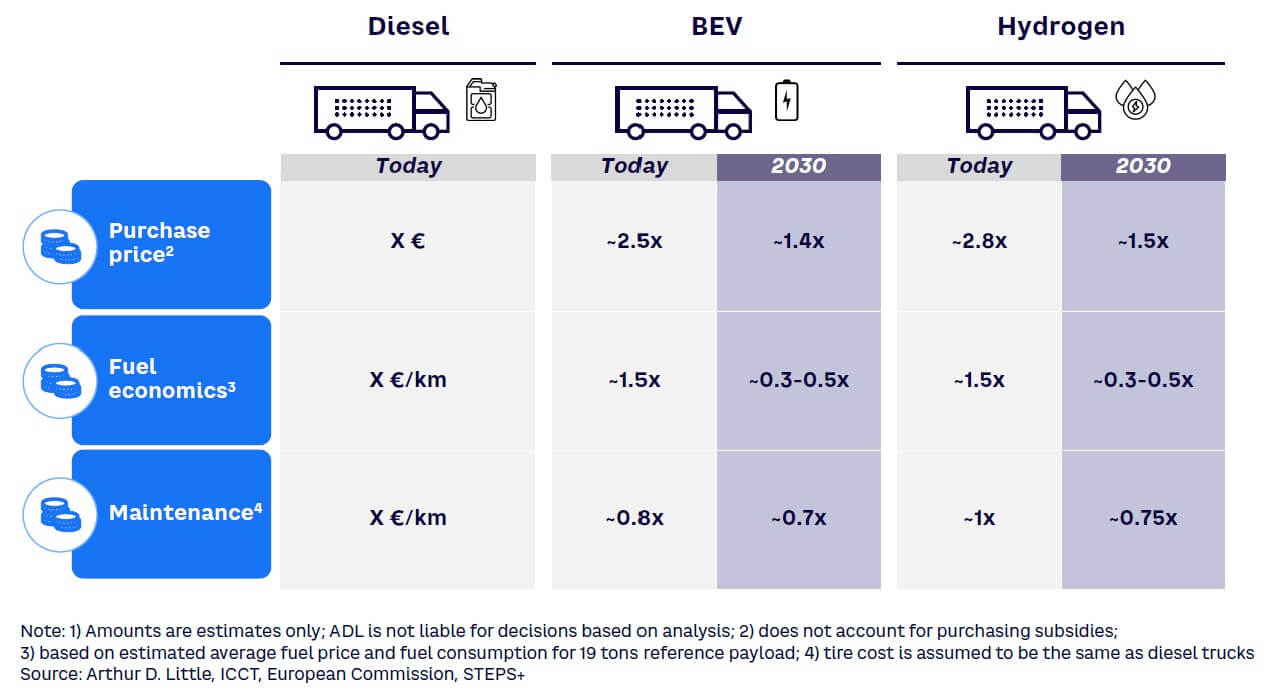

Although industry experts agree on a competitive scenario, uncertainties surround future investments and their impact on hydrogen truck costs. Today, a heavy-duty BEV truck costs two to three times more than its diesel counterpart.

A comparable hydrogen truck likely adds an additional 10%-20% compared to BEV, making the initial purchase costly for a fuel-cell truck. Retail prices for hydrogen fuel trucks are expected to significantly decrease until 2030, reaching levels of 40%-60% above comparable diesel models (this does not account for potential subsidies). A decrease in direct manufacturing costs and advancements in fuel cell unit rated power and hydrogen storage tank size will drive the vehicle price decrease.

Production costs for green hydrogen are currently around US $6 per kilogram, with a price around $8-$10 per kilogram at the pump. However, decreases in fuel costs are expected, with renewable hydrogen costs projected to reach levels of $1.4-$2.3 per kilogram by 2030. This in turn is expected to generate a price at the pump between $3-$5 per kilogram, creating room for heavy-duty hydrogen trucks to be cost competitive. In addition, fuel cell systems are lighter than batteries, so less fuel will be needed compared to BEV trucks delivering the same payload.

Maintenance and repair (M&R) costs for BEV trucks are lower compared to diesel trucks and are expected to continue decreasing. For hydrogen trucks, M&R costs are expected to be similar to those of comparable diesel trucks. However, future development and learning curve effects are expected to drive M&R costs of hydrogen trucks to levels comparable with BEV trucks.

Figure 2 highlights a possible cost scenario between comparable diesel, BEV, and hydrogen heavy-duty trucks for specific cost parameters. The comparison does not include a full total cost of ownership (TCO) analysis. For example, the American Transportation Research Institute estimates that driver wages for many carriers constitute between 20%-40% of the marginal cost per mile. Fast charging times therefore present additional potential to reduce the TCO for hydrogen trucks.

OBSTACLES TO OVERCOME

Hydrogen trucks are favored over BEV trucks for long-haul applications. However, ongoing infrastructure development is needed to address cost and fuel production. At the same time, OEMs need to scale up production to make hydrogen trucks more widely available.

Building the refueling infrastructure

In a future scenario, a two-dispenser hydrogen filling station could service 200 trucks a day, compared to a station with a fast charger servicing one BEV truck per hour.

Hydrogen trucks have longer distance ranges than BEV trucks and short refueling times, so fewer filling stations are needed when compared to the number of stations needed to charge BEV trucks, but the creation of infrastructure to support hydrogen trucking is behind its electric counterpart. For example, Europe has only a few hydrogen refueling stations that can accommodate trucks. According to the European Automobile Manufacturers Association (ACEA), the EU and the UK will need 300 hydrogen refueling stations by 2025 and 1,000 by 2030 to meet demand.

Meeting these targets will require focused investments and binding regulatory agreements with EU member states. Philips 66 and H2 Energy Europe have teamed up to build a hydrogen retail refueling network of 250 sites by 2026 across Germany, Austria, and Denmark. In addition, the European Commission recently approved €5.2 billion (~$5.8 billion) in public funding to support research, deployment, and construction of hydrogen infrastructure that focuses on renewable and low-carbon hydrogen. The funding could unlock an additional €7 billion (~$7.5 billion) in investments from the private sector.

The refueling technology ranges between liquid and gaseous (350 or 700 bar) hydrogen and standards are expected to emerge as more hydrogen filling stations are developed and made operational, which will drive cost reductions in capital expenditures and facilitate commercial rollout. Reusing elements of existing filling station infrastructure, such as compact design plans and universal components, the capital expenditure per hydrogen filling station is expected to drop by about 50% by 2030.

Capturing scale benefits to make hydrogen trucks commercially available

Projects featuring limited numbers of hydrogen fuel cell trucks are currently being piloted. Separate initiatives from the H2Accelerate Collaboration, HyTrucks, and Hyundai are expected to put an additional 4,000 hydrogen trucks on European roads by 2025.

Production at a scale of 10,000 vehicles a year is expected by the end of the decade, which is likely to result in 100,000 long-haul trucks on European roads by 2030, less than 2% of the entire truck fleet. Mass production of critical equipment, including fuel cells and tanks, is crucial for OEMs; some are partnering with suppliers to increase availability (e.g., Quantron with Ballard, Hyliko with Plastic Omnium, Man with Forvia), or are getting involved on the supply side (e.g., Daimler and Volvo created cellcentric to produce hydrogen-based fuel cells).

While purchasing price may act as an initial barrier for the widespread adoption of hydrogen trucks, lifetime fuel cost will undoubtedly be the largest financial consideration. As production grows and costs decrease, hydrogen trucks will compare favorably with diesel trucks with pump prices ranging from €3.5 to €5 (~$3.75-$5.35) per kilogram of hydrogen, according to the International Council on Clean Transportation (ICCT).

According to research conducted by ADL and others, the TCO of a hydrogen-powered heavy-duty truck is expected to be lower than the TCO of comparable diesel models by 2030. However, leading OEMs claim that potential savings from fuel and maintenance could make hydrogen trucks cheaper to own as soon as 2027.

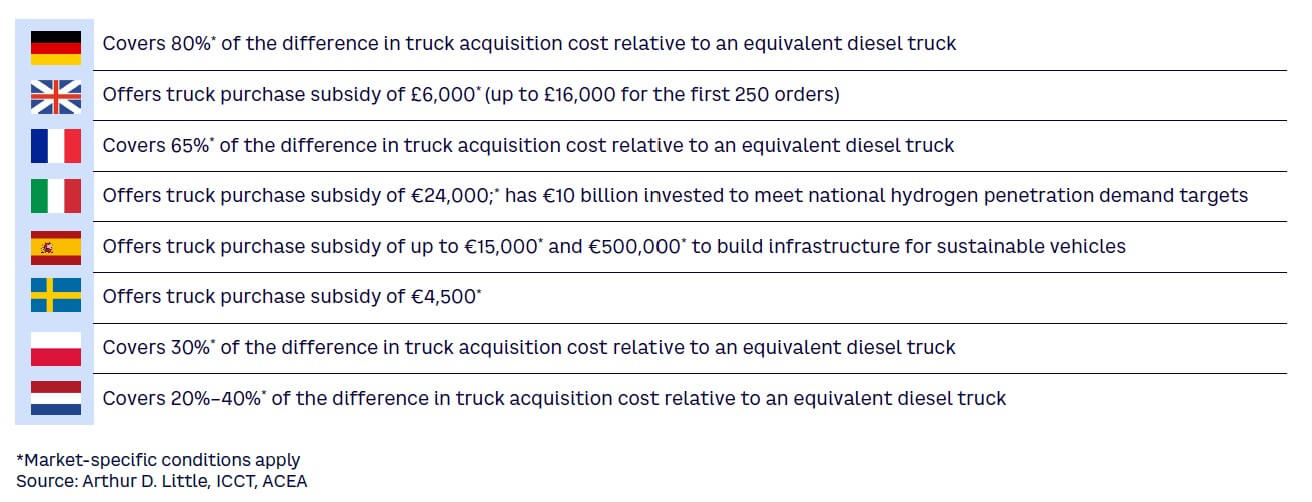

Incentivizing investment in hydrogen trucks

Government policies and subsidies to support hydrogen trucking technology are necessary for further development. European states need to push hydrogen development with subsidies to drive the investments in hydrogen infrastructure and the adoption of the technology. Initial development will then generate scale effects that will support further expansion. Multiple European states are already supporting this development by offering purchasing subsidies specifically for hydrogen trucks (see Figure 3). On a European-level, one example is the IPCEI on Hydrogen program, which aims to cover and support a clean hydrogen value chain. IPCEI Hy2Tech, for example, covers a wide segment of the hydrogen technology value chain, including end-user applications, in particular, in the mobility sector, with financing support for over 40 projects in 15 EU countries with 5.4 billion Euros. Transport emission trading systems, toll reductions, and the addition of CO2 external costs are other relevant policies and subsidies that would favor investment in green trucking alternatives. According to the ICCT, considering potential government hydrogen subsidies would further impact the cost-parity timeline.

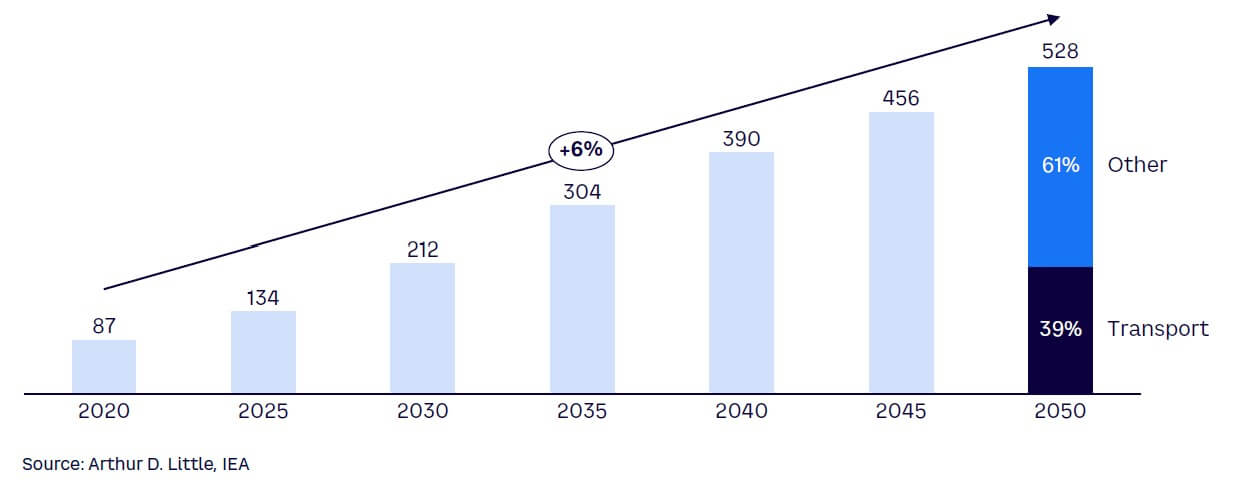

Meeting demand for hydrogen

The global hydrogen supply will need to increase sixfold, compared to 2020 levels, in order to meet the forecasted demand for hydrogen. According to the International Energy Agency (IEA), transport will constitute about 40% of consumption by 2050 (see Figure 4).

The deployment at scale of electrolysis capacity and the availability of cheap renewable electricity are two critical elements needed to meet this demand with low-carbon hydrogen.

Onsite electrolyzers are being installed with refueling stations, though the infrastructure is also designed to accommodate hydrogen supplied through tube trailers and centrally produced in future industrial hubs that are close to refineries, ammonia plants, or methanol plants. Current operational electrolyzers range from 1 to 20 megawatts each and already face technical difficulties, such as low availability, subpar expected performance, and so forth, while 30+ to 100+ megawatt projects are required to ramp up the hydrogen economy. It is projected that full technical maturity, indicated by a technology readiness level of 10 (TRL10), will be reached by the middle of this decade.

In 2021, 30+ gigawatts of renewable power purchase agreements (PPA) were signed worldwide. However, most of these projects targeted corporations (e.g., tech giants, including Google and Facebook, retailers, industrials) that until 2021 were driven by sustainability concerns but are now also eager to reduce their exposure to volatile electricity markets. Members of RE100, a global initiative comprised of more than 125 companies, have pledged to cover 100% of their energy demand with renewable electricity by 2030, which would require 90+ gigawatts of PPAs to be signed in the next eight years. Electrolysis will have to compete for renewable power with these corporations as well as with charge points for BEVs, which may require a greater amount of terawatt hours by 2030, produced by 500+ gigawatts of renewable capacity.

Conclusion

HEAVY DUTY HYDROGEN TRUCKING WILL HAPPEN

The use of hydrogen trucks is expected to increase significantly due to:

-

Its feasibility as a way to decarbonize heavy-duty and long-haul trucking.

-

Its shorter refueling times and greater distance ranges, which makes it an attractive alternative across multiple use cases.

-

Lower TCO when compared to similar diesel models, driven by expected decreases in hydrogen production costs and expected decreases in initial purchase costs.

Additional development is needed to expand the hydrogen charging infrastructure, secure green hydrogen sourcing, and incentivize future development of hydrogen trucks, which will require private-public collaboration and joint investments.