DOWNLOAD

11 min read • Marketing & sales

Turning customers into subscribers – How to successfully make the shift

What customers expect from manufacturing businesses is changing, moving away from outright purchase- to subscription-based models. This offers opportunities and risks for traditional players, providing them with access to greater customer insight, but also lowering barriers for competitors. Based on case examples, this article looks at how manufacturers can make the shift to subscriptionbased businesses.

As manufacturing firms face ever-increasing global competition and pressure on margins, the prospect of capturing more value through services – rather than just products – remains a key strategic priority. Manufacturing companies that employ best practices can make 45–65 percent of their revenues through services, with EBIT margins of 18 percent or more1, and typically well in excess of product margins. There are some long-established, well-known examples of the product-to-service shift, including Rolls Royce’s Powerby- the-Hour model for jet engines and tool manufacturer Hilti’s Fleet Management model, in which customers are guaranteed availability of equipment when it is needed at a monthly fixed rate.

In recent years, trends in digital technologies, changing customer behaviors, and threats from new data-rich competitors have brought urgency for manufacturing companies to move still further into services, and to form deeper and closer relationships with customers through subscription models. However, this isn’t always as easy as it sounds. Not all customers like the idea of being tied to one supplier, and new service-based business models do not always deliver the expected returns. In this article we look at some of the challenges for companies moving towards subscription-based business models and highlight an approach they can adopt to increase their likelihood of success.

Why subscription models are becoming more important

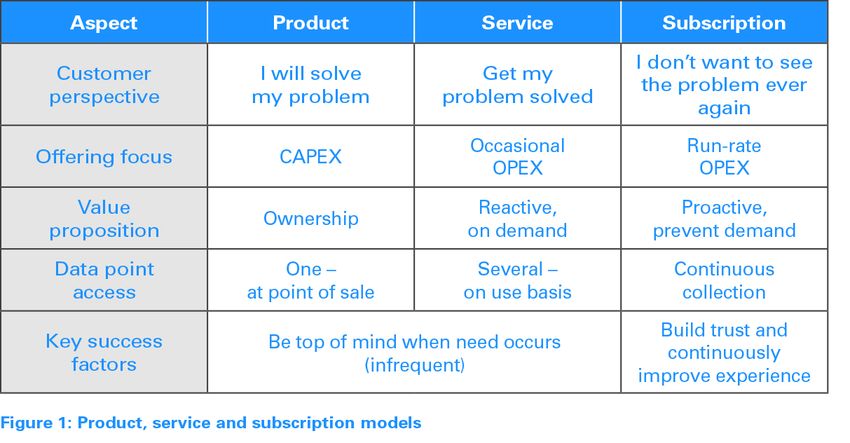

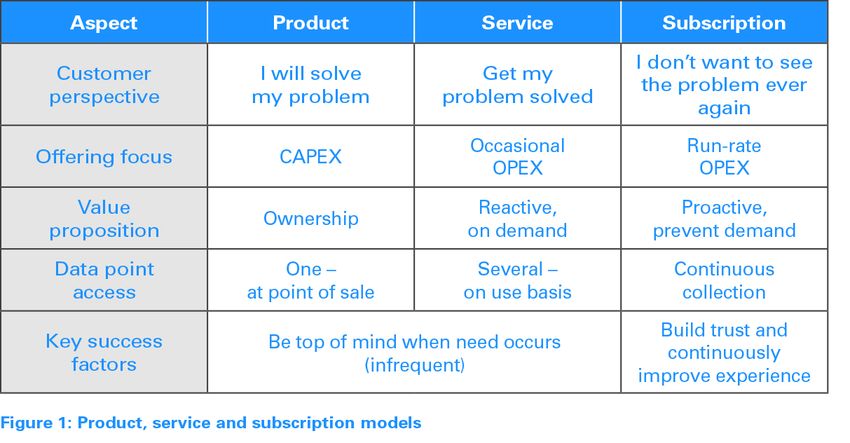

Manufacturing companies traditionally provide products thatcustomers buy to solve problems, meet needs and perform functions. While a service model implies shifting from product ownership to product access on a reactive, pay-per-use basis, a subscription model means having a proactive, long-term customer relationship with recurring fees, as shown in Figure 1.

In recent years, subscription models have become much more important due to a combination of powerful market-pull and technology-push factors:

- Market pull – Changing customer expectations: Customers, whether in the business or consumer market, are increasingly demanding more tailored user experiences, which means manufacturers need to achieve much deeper customer insight. Business customers are more likely to look at products as a means to achieve “jobs to be done” than as assets they need to own. Enabled by effective external-partner ecosystems, companies are increasingly keen to focus on their core differentiators (their “raison d’etre”) to maintain flexibility and avoid unnecessary CAPEX, externalizing whatever is non-core2.

Product ownership is less important than the quality and customizability of the experience for consumers as well – hence, for example, the rise of mobility-as-a-service (MaaS) instead of car ownership and streaming services instead of recorded media.

- Technology push – Connectedness and data: Availability of connected, smart devices is causing value to shift from hardware to software. The ability to generate and analyze data with unprecedented sophistication provides huge opportunities for companies to gain insight and create new value within customer relationships, especially those that are long-term.

For traditional manufacturing companies, these rapidly evolving trends offer up many new opportunities to gain business advantage.

However, there is also a significant threat in terms of new competition. Previously, competitive advantage relied on manufacturing and distribution efficiency on the one hand, and customer knowledge accumulated over time on the other. However, the value of experience is eroding in an economy in which manufacturing capabilities can be outsourced efficiently (or built up rapidly) and data on customers’ needs, preferences, and usage patterns can be collected elsewhere.

Therefore, now competition is not solely from companies providing similar products, but also new players that can identify and address the customer’s basic need for which products are used. An example of this is the growth of subscription-based carpools and MaaS solutions, which have started to erode the tradition car-rental market. Other examples of potential new competitors include Amazon and Google, whose voice assistants increasingly tap into the wealth of information surrounding purchase decisions, such as the circumstances that may spark the idea of a purchase, what questions are important during the research phase, and what triggers the buying decision. This quality of data can enable development of new and radically different solutions that address customer needs before the customer even recognizes them as needs. Manufacturing companies need to ensure that they are not left behind in the face of these new competitive threats.

The benefits to companies

Manufacturing companies that have operationalized subscription models which exploit their full potential can enjoy a variety of benefits, for example:

- Greater customer insight: Deeper understanding of customer needs and behaviors, which is fundamental to effective product and service innovation.

- Stronger customer relationships: Greater customer intimacy, increased loyalty and customer stickiness, higher customer satisfaction.

- Better margins: Increased value-add to the customer, which enables premium higher-margin services.

- More growth: The potential to grow revenues through broadening the service range, as well as recruiting new subscribers.

- Greater stability: less volatility, stabler and more predictable cash flows. For example, new AI applications enable companies to optimize offerings and pricing, and as a result, prevent churn and maximize life cycle value.

Signify and SKF are two examples of companies which have monetized the subscription model.

Box 1 – Signify and SKF – Monetizing the subscription model

Light manufacturer Signify, formerly Philips Lighting3, offers major customers such as airports, malls, and office complexes the opportunity to subscribe to light-as-a-service through its Managed Services concept. Rather than purchasing, installing and changing lights and fixtures themselves, customers avoid CAPEX (and maintenance fees) through outsourcing this to Signify for a lower recurring (OPEX) cost. During the contract, Signify retains ownership of the products and is responsible for managing all the customer’s lighting needs. Typically, customers see total cost reductions of around 50 percent, as the new business model enables tailoring the light supply based on consumption. Signify also offers connected lighting solutions in which each luminaire contains an IoT sensor that captures data – regarding not only lighting needs and “bulbhealth” to enable predictive maintenance, but also activity levels and environmental parameters within buildings. This, in turn, enables customers to analyze this insight and tailor their own offerings. Signify is now targeting the consumer market with a subscription model.

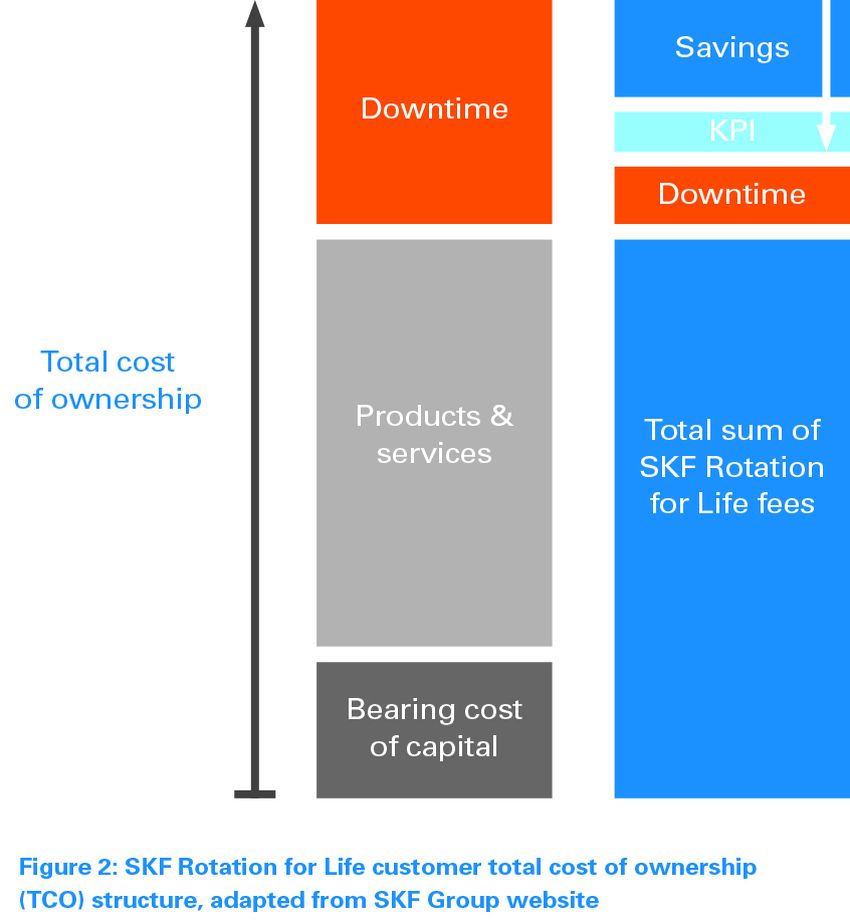

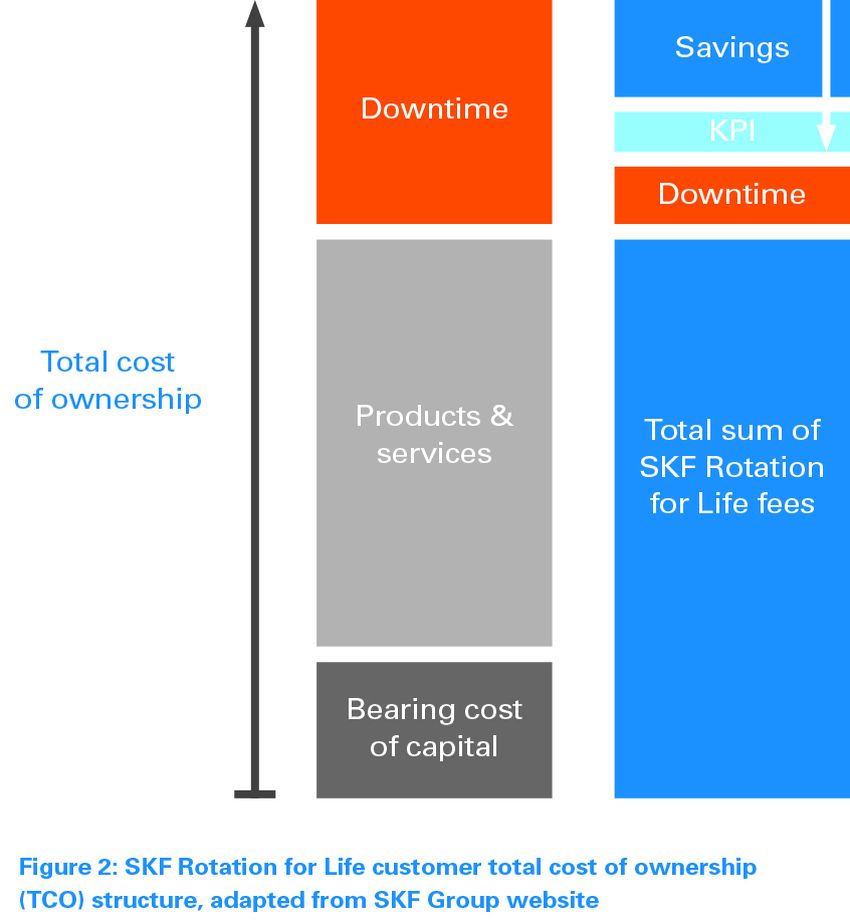

Bearings company SKF also demonstrates the benefits of a subscription model. Its new Rotation for Life concept offers customers production by the hour, including service, seals, and lubrication4. Through performance contracts, SKF ensures customers’ rotating machinery operates as agreed and process performance targets are met. IoT sensors, currently monitoring over 4 million measuring points, equip the bearings. This allows condition monitoring and predictive maintenance, which elongates product life spans while reducing down time and operational costs. Expected reductions in customers’ TCO are illustrated in Figure 2. President and CEO Alrik Danielsson stresses the importance of data for the concept’s success, but also concludes that “there has to be a significant mind-set shift at both manufacturer and customer level for performance contracts to flourish.”

The new business models from Signify and SKF share common characteristics. Both offer tailored customer experiences that are constantly updated with the latest features, with maximized up-time and often lower TCO. At the same time, they are building continuous customer relationships (and revenues) and can lower their operational costs through predictability and prioritization of efforts according to what drives value for their customers. They have refocused incentive programs so employees are no longer motivated to sell more products year on year, but rather, to develop top-quality, sustainable products – which also drives a move towards circular business models. This delivers advantages for the manufacturer, its customers, and the environment.

The challenges of moving to a subscription model

However, as well as the success stories, there are many examples of manufacturing companies struggling to make the shift towards service-based models and failing to reach profitability, when both transforming from old business models and establishing new ones from scratch. For example, Michelin Tires launched Michelin Fleet Solutions, offering customers tires for a monthly fee, including replacements and maintenance5. The venture proved challenging due to multiple factors:

- Difficulties in demonstrating benefits for customers.

- Internal resistance through misalignment of incentives. The sales force was hesitant to adopt the new offering because its primary KPI was still the number of new tires sold.

- Complex cost structures proved difficult to manage, as did the added intricacies of the relationships and split of responsibilities with distributors along the value chain.

The combination of these challenges led to transformation of the concept. Michelin has now relaunched it with IoT connectivity, using sensors to measure pressure, temperature and speed, which allows it to provide customized data offerings to customers. Time will tell whether this reworked, improved effort will prove successful.

Other examples include German automotive supplier Dürr, which was unable to monetize its product-to-service efforts due to lack of internal cost control6. Intel’s web-based services division was discontinued within a few years, and Siemens’ Business Services division had difficulties generating sustainable profits.

In general, companies that struggle to make the change often fail to:

- Spend enough time formulating deep understanding of customer perspective and benefits

- Develop the necessary capabilities to address critical datastrategy issues

- Align the whole organization behind the new business model (as opposed to just the delivery model).

Delivering on growing customer expectations, and thus remaining competitive in a converging industrial landscape, increasingly requires access to data around product usage. Yet, most traditional manufacturing companies are not set up to collect and leverage relevant data.

How to overcome the challenges

To successfully introduce a subscription model, companies need to focus on four priorities:

- Develop deep insight into customer needs and desires The starting point for successful transformation is gaining deep understanding of customer needs, including those that may be inferred rather than expressed, and identifying whether and how a subscription model could address those needs. Typically, this means developing a truly customercentric perspective, looking much more broadly beyond product-related services, towards customer objectives, desires and constraints. This needs to include understanding the nature of customer resistance to subscriptions – customers will not commit to subscriptions if they do not significantly help them. For example, if customers believe a company will use their data and information to create customized offerings which exceed expectations, they are more likely to commit.

- Place data at the center of the strategy Companies should focus on how data is to be gathered, analyzed and exploited in any move to a subscription model. Offering superior, customized products and services comes directly from customer-insight generation, which requires adequate quantity and quality of relevant data, as well as appropriate skills to analyze it. Competitive analysis from a data perspective becomes critical, alongside reviewing the company’s value proposition portfolio in relation to customer behavior to establish where the subscriptionized business model could fit in. Subscription-based models require new technological capacity, such as using sensors to capture data, data analytics, and AI capabilities to create superior, tailored offerings. They also need capabilities within manufacturing, in terms of adopting techniques such as DevOps and agile production.

- Align internal functions and processes For a successful business-model shift, an organization’s internal departments must be adequately incentivized and aligned with a shared vision that clearly recognizes the move from product oriented to data oriented. Sales, operations, and R&D must all work towards the same vision and be compensated not based on the number of products that can be pushed out – but on, for example, total profitability or number of subscription customers. Business transformation is key. A business-model shift entails a significant change in many internal processes, and often involves new sales channels.

- Adopt a step-by-step approach As with any new business trend gaining traction, there is temptation – especially for incumbent firms – to dive in head first. After all, incumbents have the capital to make it happen and are (rightly) cognizant of the risk of being surpassed by new market disruptors. However, this often leads to focus on the delivery model itself (the what), rather than the entire business model (the how and the why). In our experience, companies that have been successful have taken sufficient time to assess the strategic position before acting (as in 1 and 2 above).

Although customization is a key value-add from the subscription model, not everything can be customized at once. Companies can prioritize and create one “wow” dimension at a time, until they gain the required amount of data to create truly tailored offerings. For example, the first step could be a set-up in which the subscription depends on use frequency and intensity, while different fee levels are trialed. By incrementally building understanding of which customers use which model, when, and how, firms can increase the level of customization per subscription step by step.

Insight for the executive

To remain differentiated in an increasingly competitive and converging industrial landscape, companies must gain access to, and generate insight from, customer data in order to deliver superior and customized offerings. Adopting a subscription-based business model is a key method of achieving this. However, implementing a subscription model requires a fundamental shift in a company’s overall business logic and incentive alignment, creation of new internal skills and capabilities, and agility to adjust in a transformed external ecosystem.

With data access a key competitive advantage, product companies in both B2B and B2C markets will have to re-evaluate their competitive landscapes, looking out for players with similar or better customer insight – on relevant parameters – rather than focusing on players with similar or better product or service offerings. This establishes a continuous customer relationship, which enables data generation, accumulation of customer insight, and ultimately, improved offerings. For many manufacturing companies the move to subscription models – not just services – will be the key battleground for ensuring future competitive advantage.

11 min read • Marketing & sales

Turning customers into subscribers – How to successfully make the shift

What customers expect from manufacturing businesses is changing, moving away from outright purchase- to subscription-based models. This offers opportunities and risks for traditional players, providing them with access to greater customer insight, but also lowering barriers for competitors. Based on case examples, this article looks at how manufacturers can make the shift to subscriptionbased businesses.

As manufacturing firms face ever-increasing global competition and pressure on margins, the prospect of capturing more value through services – rather than just products – remains a key strategic priority. Manufacturing companies that employ best practices can make 45–65 percent of their revenues through services, with EBIT margins of 18 percent or more1, and typically well in excess of product margins. There are some long-established, well-known examples of the product-to-service shift, including Rolls Royce’s Powerby- the-Hour model for jet engines and tool manufacturer Hilti’s Fleet Management model, in which customers are guaranteed availability of equipment when it is needed at a monthly fixed rate.

In recent years, trends in digital technologies, changing customer behaviors, and threats from new data-rich competitors have brought urgency for manufacturing companies to move still further into services, and to form deeper and closer relationships with customers through subscription models. However, this isn’t always as easy as it sounds. Not all customers like the idea of being tied to one supplier, and new service-based business models do not always deliver the expected returns. In this article we look at some of the challenges for companies moving towards subscription-based business models and highlight an approach they can adopt to increase their likelihood of success.

Why subscription models are becoming more important

Manufacturing companies traditionally provide products thatcustomers buy to solve problems, meet needs and perform functions. While a service model implies shifting from product ownership to product access on a reactive, pay-per-use basis, a subscription model means having a proactive, long-term customer relationship with recurring fees, as shown in Figure 1.

In recent years, subscription models have become much more important due to a combination of powerful market-pull and technology-push factors:

- Market pull – Changing customer expectations: Customers, whether in the business or consumer market, are increasingly demanding more tailored user experiences, which means manufacturers need to achieve much deeper customer insight. Business customers are more likely to look at products as a means to achieve “jobs to be done” than as assets they need to own. Enabled by effective external-partner ecosystems, companies are increasingly keen to focus on their core differentiators (their “raison d’etre”) to maintain flexibility and avoid unnecessary CAPEX, externalizing whatever is non-core2.

Product ownership is less important than the quality and customizability of the experience for consumers as well – hence, for example, the rise of mobility-as-a-service (MaaS) instead of car ownership and streaming services instead of recorded media.

- Technology push – Connectedness and data: Availability of connected, smart devices is causing value to shift from hardware to software. The ability to generate and analyze data with unprecedented sophistication provides huge opportunities for companies to gain insight and create new value within customer relationships, especially those that are long-term.

For traditional manufacturing companies, these rapidly evolving trends offer up many new opportunities to gain business advantage.

However, there is also a significant threat in terms of new competition. Previously, competitive advantage relied on manufacturing and distribution efficiency on the one hand, and customer knowledge accumulated over time on the other. However, the value of experience is eroding in an economy in which manufacturing capabilities can be outsourced efficiently (or built up rapidly) and data on customers’ needs, preferences, and usage patterns can be collected elsewhere.

Therefore, now competition is not solely from companies providing similar products, but also new players that can identify and address the customer’s basic need for which products are used. An example of this is the growth of subscription-based carpools and MaaS solutions, which have started to erode the tradition car-rental market. Other examples of potential new competitors include Amazon and Google, whose voice assistants increasingly tap into the wealth of information surrounding purchase decisions, such as the circumstances that may spark the idea of a purchase, what questions are important during the research phase, and what triggers the buying decision. This quality of data can enable development of new and radically different solutions that address customer needs before the customer even recognizes them as needs. Manufacturing companies need to ensure that they are not left behind in the face of these new competitive threats.

The benefits to companies

Manufacturing companies that have operationalized subscription models which exploit their full potential can enjoy a variety of benefits, for example:

- Greater customer insight: Deeper understanding of customer needs and behaviors, which is fundamental to effective product and service innovation.

- Stronger customer relationships: Greater customer intimacy, increased loyalty and customer stickiness, higher customer satisfaction.

- Better margins: Increased value-add to the customer, which enables premium higher-margin services.

- More growth: The potential to grow revenues through broadening the service range, as well as recruiting new subscribers.

- Greater stability: less volatility, stabler and more predictable cash flows. For example, new AI applications enable companies to optimize offerings and pricing, and as a result, prevent churn and maximize life cycle value.

Signify and SKF are two examples of companies which have monetized the subscription model.

Box 1 – Signify and SKF – Monetizing the subscription model

Light manufacturer Signify, formerly Philips Lighting3, offers major customers such as airports, malls, and office complexes the opportunity to subscribe to light-as-a-service through its Managed Services concept. Rather than purchasing, installing and changing lights and fixtures themselves, customers avoid CAPEX (and maintenance fees) through outsourcing this to Signify for a lower recurring (OPEX) cost. During the contract, Signify retains ownership of the products and is responsible for managing all the customer’s lighting needs. Typically, customers see total cost reductions of around 50 percent, as the new business model enables tailoring the light supply based on consumption. Signify also offers connected lighting solutions in which each luminaire contains an IoT sensor that captures data – regarding not only lighting needs and “bulbhealth” to enable predictive maintenance, but also activity levels and environmental parameters within buildings. This, in turn, enables customers to analyze this insight and tailor their own offerings. Signify is now targeting the consumer market with a subscription model.

Bearings company SKF also demonstrates the benefits of a subscription model. Its new Rotation for Life concept offers customers production by the hour, including service, seals, and lubrication4. Through performance contracts, SKF ensures customers’ rotating machinery operates as agreed and process performance targets are met. IoT sensors, currently monitoring over 4 million measuring points, equip the bearings. This allows condition monitoring and predictive maintenance, which elongates product life spans while reducing down time and operational costs. Expected reductions in customers’ TCO are illustrated in Figure 2. President and CEO Alrik Danielsson stresses the importance of data for the concept’s success, but also concludes that “there has to be a significant mind-set shift at both manufacturer and customer level for performance contracts to flourish.”

The new business models from Signify and SKF share common characteristics. Both offer tailored customer experiences that are constantly updated with the latest features, with maximized up-time and often lower TCO. At the same time, they are building continuous customer relationships (and revenues) and can lower their operational costs through predictability and prioritization of efforts according to what drives value for their customers. They have refocused incentive programs so employees are no longer motivated to sell more products year on year, but rather, to develop top-quality, sustainable products – which also drives a move towards circular business models. This delivers advantages for the manufacturer, its customers, and the environment.

The challenges of moving to a subscription model

However, as well as the success stories, there are many examples of manufacturing companies struggling to make the shift towards service-based models and failing to reach profitability, when both transforming from old business models and establishing new ones from scratch. For example, Michelin Tires launched Michelin Fleet Solutions, offering customers tires for a monthly fee, including replacements and maintenance5. The venture proved challenging due to multiple factors:

- Difficulties in demonstrating benefits for customers.

- Internal resistance through misalignment of incentives. The sales force was hesitant to adopt the new offering because its primary KPI was still the number of new tires sold.

- Complex cost structures proved difficult to manage, as did the added intricacies of the relationships and split of responsibilities with distributors along the value chain.

The combination of these challenges led to transformation of the concept. Michelin has now relaunched it with IoT connectivity, using sensors to measure pressure, temperature and speed, which allows it to provide customized data offerings to customers. Time will tell whether this reworked, improved effort will prove successful.

Other examples include German automotive supplier Dürr, which was unable to monetize its product-to-service efforts due to lack of internal cost control6. Intel’s web-based services division was discontinued within a few years, and Siemens’ Business Services division had difficulties generating sustainable profits.

In general, companies that struggle to make the change often fail to:

- Spend enough time formulating deep understanding of customer perspective and benefits

- Develop the necessary capabilities to address critical datastrategy issues

- Align the whole organization behind the new business model (as opposed to just the delivery model).

Delivering on growing customer expectations, and thus remaining competitive in a converging industrial landscape, increasingly requires access to data around product usage. Yet, most traditional manufacturing companies are not set up to collect and leverage relevant data.

How to overcome the challenges

To successfully introduce a subscription model, companies need to focus on four priorities:

- Develop deep insight into customer needs and desires The starting point for successful transformation is gaining deep understanding of customer needs, including those that may be inferred rather than expressed, and identifying whether and how a subscription model could address those needs. Typically, this means developing a truly customercentric perspective, looking much more broadly beyond product-related services, towards customer objectives, desires and constraints. This needs to include understanding the nature of customer resistance to subscriptions – customers will not commit to subscriptions if they do not significantly help them. For example, if customers believe a company will use their data and information to create customized offerings which exceed expectations, they are more likely to commit.

- Place data at the center of the strategy Companies should focus on how data is to be gathered, analyzed and exploited in any move to a subscription model. Offering superior, customized products and services comes directly from customer-insight generation, which requires adequate quantity and quality of relevant data, as well as appropriate skills to analyze it. Competitive analysis from a data perspective becomes critical, alongside reviewing the company’s value proposition portfolio in relation to customer behavior to establish where the subscriptionized business model could fit in. Subscription-based models require new technological capacity, such as using sensors to capture data, data analytics, and AI capabilities to create superior, tailored offerings. They also need capabilities within manufacturing, in terms of adopting techniques such as DevOps and agile production.

- Align internal functions and processes For a successful business-model shift, an organization’s internal departments must be adequately incentivized and aligned with a shared vision that clearly recognizes the move from product oriented to data oriented. Sales, operations, and R&D must all work towards the same vision and be compensated not based on the number of products that can be pushed out – but on, for example, total profitability or number of subscription customers. Business transformation is key. A business-model shift entails a significant change in many internal processes, and often involves new sales channels.

- Adopt a step-by-step approach As with any new business trend gaining traction, there is temptation – especially for incumbent firms – to dive in head first. After all, incumbents have the capital to make it happen and are (rightly) cognizant of the risk of being surpassed by new market disruptors. However, this often leads to focus on the delivery model itself (the what), rather than the entire business model (the how and the why). In our experience, companies that have been successful have taken sufficient time to assess the strategic position before acting (as in 1 and 2 above).

Although customization is a key value-add from the subscription model, not everything can be customized at once. Companies can prioritize and create one “wow” dimension at a time, until they gain the required amount of data to create truly tailored offerings. For example, the first step could be a set-up in which the subscription depends on use frequency and intensity, while different fee levels are trialed. By incrementally building understanding of which customers use which model, when, and how, firms can increase the level of customization per subscription step by step.

Insight for the executive

To remain differentiated in an increasingly competitive and converging industrial landscape, companies must gain access to, and generate insight from, customer data in order to deliver superior and customized offerings. Adopting a subscription-based business model is a key method of achieving this. However, implementing a subscription model requires a fundamental shift in a company’s overall business logic and incentive alignment, creation of new internal skills and capabilities, and agility to adjust in a transformed external ecosystem.

With data access a key competitive advantage, product companies in both B2B and B2C markets will have to re-evaluate their competitive landscapes, looking out for players with similar or better customer insight – on relevant parameters – rather than focusing on players with similar or better product or service offerings. This establishes a continuous customer relationship, which enables data generation, accumulation of customer insight, and ultimately, improved offerings. For many manufacturing companies the move to subscription models – not just services – will be the key battleground for ensuring future competitive advantage.